Say Insurance, part of Shelter Insurance, is a new single-line automotive insurance company that is active in 5 states. The company aims to increase the transparency, clarity, and knowledge of the auto insurance buying process for consumers, giving them greater insight into what they can do to reduce their rates, minimize risk, and have more control of their policy.

Say believe auto insurance should be frustration-free and simple so they provide all of the information necessary to make sound decisions on coverage plans. This experience is delivered through an online portal that gives consumers the complete range of information available about their insurance score — which serves a similar purpose as a credit score and ultimately affects pricing — and coverage options.

Customer Since

2017

Use case

Sales & Marketing

Solution

GoodData Enterprise Insights Platform

Favourite metrics

Retention rate / 180-day retention rate for top 3 segments

Best features

Predictive analytics / Ability to instantly access data and find answers on the fly

Giving users the transparent and clear experience that Say wanted to provide was unusual for the insurance industry, which tends to be secretive. “We felt it was important to let people know their insurance score and to give them tangible recommendations for what they could do to ultimately get better rates from insurers,” explained Mike Terry, Business Analyst. Marc Deiter, Director of Say Insurance, continued, “An insurance score is a powerful tool that is a major factor in what kind of rates customers receive.

Say Insurance is committed to not only allowing people to access their score up front, but also talking through the details of how it’s calculated and impacts their plan and rates.”

Say was created as a separate brand for Shelter Insurance after it became clear that this online experience would require dramatically different skills and thought processes than those required for traditional insurance sales. “Shelter has been around for 70 years, so they have deep knowledge and some serious experience with what we call the ‘captive agent channel,’” explained Terry. “When Shelter wanted to expand into direct insurance sales, they discovered that different skills applied to that channel, and Say Insurance was created as an entirely new brand.”

Results with GoodData

- Saved 2-3 hours creation time per report per week

- Connected online activity to long- term policy performance

- Shortened time required to answer data questions

- Users can follow their curiosity to more answers

- More robust reporting, available anywhere

Entering uncertain territory

Right away, it was clear that there were unique challenges to the direct channel. “Because agents meet with customers in person, they’re able to form a real relationship and have an in-depth conversation about what the customer is looking for,” said Terry.

“There is a lot of information in that relationship that never makes it into a database. We no longer had the advantages that agents have, so we needed another way to find out more about who our customers are and what they really need by taking advantage of all the new sources of information that come with e-commerce.”

In addition, being a new company with a need to share significant amounts of and types of data that was also easy to understand presented its own challenges. “Questions in analytics tend to be bottomless. As soon as you answer one question, there is another question that follows it. We needed to get to a point where I, as the primary BI analyst, wasn’t a bottleneck for everyone else in the company,” said Terry. Say wanted to instead give people the tools they need to answer their own questions, recognize patterns, and take action to impact the business—all without needing to submit a request for manual analysis. It was important that all employees had access to the insights that each individual needed right when they were making a decision or taking action.

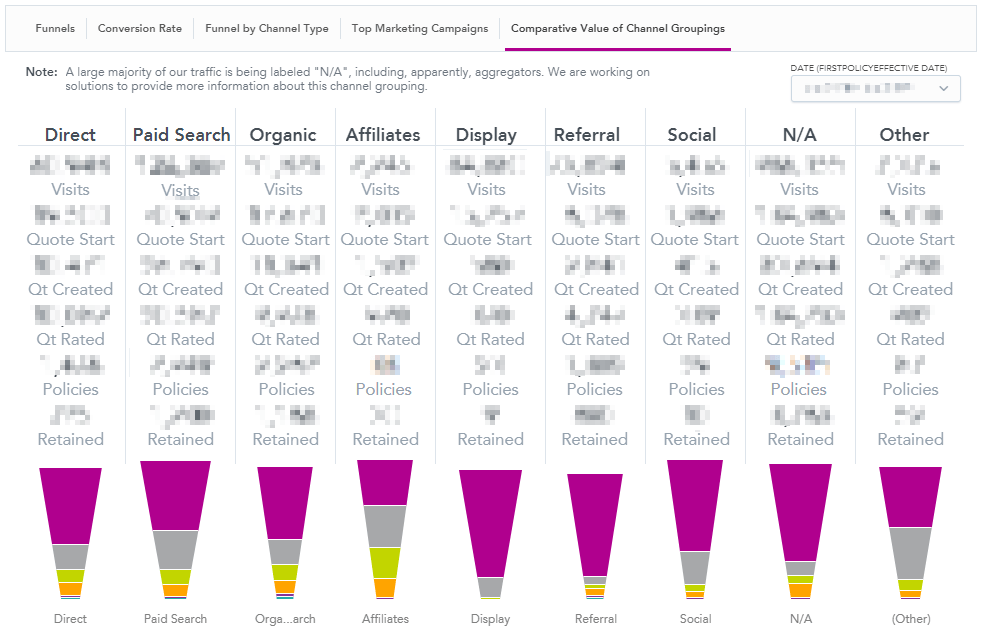

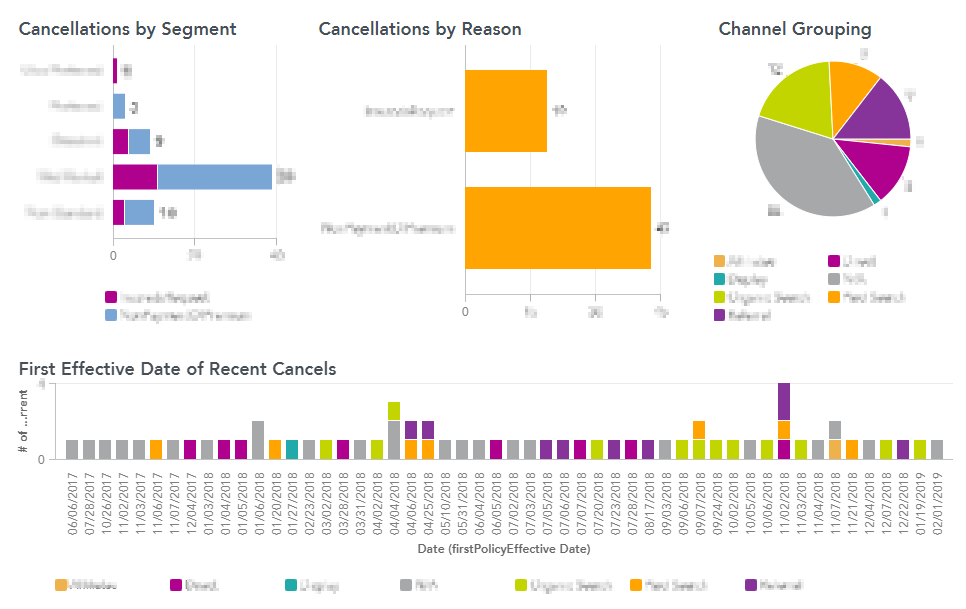

To be able to grow quickly while providing excellent customer service is going to require forecasting and robust data analysis to support that growth. “When we hire new people, it can take months to get them up to speed,” said Terry. They also wanted insight into where their marketing dollars were having the greatest effect. “We want to be able to see if spending a certain amount of money in a certain city is more or less likely to generate a call to our call center,” said Terry. “Knowing which marketing channels will generate calls will help us if we are in a position when we need to manage call volume without hurting growth.” Deiter shares, “Being able to effectively attribute policy acquisition to a source and evaluate the performance of that acquisition channel with data associated to the policy will be key to achieving important milestones in Say’s maturity.”

Finding the right partner

Right away, Say knew that they wanted to partner with an organization to find a platform that could handle all of their disparate needs. Terry explained, “We knew how much time it takes to build mature applications. We were trying to compete with more established insurance companies, and we just didn’t have the resources to build all the applications from scratch that met our requirements and could get us to market extremely quickly.” This point was emphasized by Say’s desire to use existing hardware and infrastructure. “We knew our agility would be compromised by competing demands from the rest of the company if we didn’t look elsewhere for a full end-to-end analytics platform,” said Terry. “We wanted a partner that would bring analytics expertise to Say Insurance, along with the ability to manage everything from the data warehouse to the data ingestion and cleansing to full data governance. Obviously, security is a big concern in the insurance industry, so we also needed a partner that can meet and exceed every security requirement regulation confidently.” When Say met with GoodData, they knew right way that they had found their partner. “GoodData demonstrated to us that they have the ability to efficiently use limited resources to broadly share relative data to decision makers,” said Deiter.

Say also acknowledged the work required to keep analytic applications up to date on their own. “If we build our own system from scratch, it may perfectly meet our needs today, but two years down the road it won’t be state-of- the-art anymore,” said Terry. “A company like GoodData is always focused on offering the most current and innovative solutions in the market. They continuously improve the product since it’s their core product. We want to focus on our core expertise—insurance—and partner with a vendor that is always focused on their IP. You can’t get that with an in-house team.”

Road to success

Once Say launched their analytic application with the GoodData platform, it immediately began saving employees time and helping them make decisions around marketing spend and strategic initiatives regarding the website design and resource allocation. “To show how easy GoodData is to use and how customizable it is to each user’s needs, one of the first things I built was a dashboard for my boss, who needed the same seven data points on a regular basis,” said Terry. “He now has access to these insights whenever he needs them, he sees the data every day instead of just once a month like before, and I gain back the 4-5 hours a month I spent pulling that data. It was a quick win with very clear metrics for both of us.” Deiter confirms, “One of the first things I look at every morning are those key metrics in GoodData.”

Terry began creating more custom metrics to help impact the business. “I created a KPI that is the 180-day retention rate in our top 3 segments,” said Terry. “It’s 20% higher than our overall retention rate, so it gives us insight into our decisions and actions in terms of keeping the best customers and targeting the right segments.”

This isn’t the only immediate benefit that Say was able to realize. “Personally, I love that, when I’m asked a question in a meeting, I no longer have to say ‘Well, let me get back to you with that,” said Terry. “I have all the information I need at my fingertips. I can pull the data up on my phone and get the answer I need in real time.”

Before GoodData, Say was using 4-5 different sources for their reporting. In addition to wasting valuable time toggling between applications, this also meant that it was difficult to pull the disparate data sources together for analysis. “Before, I could pull data from Tableau and EMR and Google Analytics and tell you how many people came to the website and how many started the quote process, but I couldn’t get that data to interact,” said Terry. “Now, we can unify and join the data, and I can draw clear lines and give a 360-degree view of the customer. This is immensely helpful when implementing and launching marketing campaigns and for our customer service department.”

A big push for Say was to act as an educational resource for the public by sharing the individual insurance score with each person. “Most people have never heard of an insurance score,” said Terry. “Since we’re trying to build our brand around transparency, we wanted to be able to give people this insight and help them understand what affects their rating.” Now users can come to the website and see their score, and Say is able to see how accessing the insurance score affects the user’s decision to purchase.

As mentioned, security was also a key area of concern for Say. “We take privacy very seriously, and most reporting tools either only give access to aggregated data at a level that’s not very useful or you get a canned static report in your email and that’s it,” said Terry. “If I wanted to drill down into the data, it either wasn’t available or I had to be hardwired into the network.” Say worked with GoodData’s security team to get a robust set of data that security has approved for access outside the building, enabling employees to pull up the insights they need when they need them, with no risks to customer privacy.

The fluid and interactive design allows Say Insurance to look at both a high and granular level of how the marketing efforts are performing.The marketing department began tagging all marketing campaigns, extracting the data, and tying it to long-term policy performance using the insights provided by GoodData. They took data from disparate sources to get a full picture of their marketing campaign performance. The marketing department can drill down to see the success of a campaign, not only at a content level but at a geography level, and tie it back to consumer behavior. With these insights, they are able to optimize their marketing strategy to better serve, attract and acquire individuals that are looking for a different kind of auto insurance. “This was hugely exciting,” said Terry. “We were never able to do something like this before.” They are now able to take that data and the campaign source ID created by the marketing department, see where each user came from, understand the buyer journey—in this case, see how far in the quote process they got and whether they purchased—and uncover the cost of customer acquisition to determine the profitability of the customer.

“We initially rolled out our implementation with executives and power users in the marketing department,” said Terry. “In the next phase, we’re planning on expanding our capabilities and access to insights to other departments, eventually getting to the point where someone in the call center could look at the history of a policy or customer information, so they can tailor the sales experience to that person.”

“I think it’s universally understood that IT departments always have more work than capacity,” said Terry. “Partnering with GoodData gives us so much more flexibility in terms of capacity. I love that, with our service- level agreement, it’s quick and easy to make all kinds of adjustments needed to support the growth of Say.”

Additional resources

If you’d like to discover more about embedded analytics and the GoodData platform, we have a number of additional resources available.

Learn more

Visit GoodData’s embedded analytics website to learn more about different types of embedded analytics, solutions, benefits, and additional customer success stories.

Embedded analytics trial

With the embedded analytics trial, you can see GoodData’s analytics platform embedded in

an application’s user interface so you can get a clear example of what embedded ad hoc data discovery looks like. Explore a demo application enhanced by analytics visualizations, then create analytical insights using an intuitive drag-and- drop experience.

Does GoodData look like the better fit?

Get a demo now and see for yourself. It’s commitment-free.