The Mercatus cloud-based asset and investment management software is designed for global funds who invest in alternative assets, such as renewable energy, real estate, or infrastructure. By automating many of the processes that go into data collection and analysis, Mercatus gives alternative asset investors the data and insights they need to make more informed decisions, better manage their assets, funds, and portfolios, accurately predict performance and risk, and drive better returns and investor confidence.

Customer Since

2014

Use case

Automation of data and analytics to drive greater returns on alternative investments

Solution

Powered by GoodData

How Mercatus software helps companies

“If a fund manager is considering a big infrastructure project, for example,” explains Jason Adams, Vice President, Product and Engineering, “there are literally hundreds of questions that go into the analysis of whether or not it’s a good investment. Questions like, what are the potential risks and returns? How is this sector performing in the global market? What’s the reputation of the developer(s)? How have other, similar projects performed? Does this project fit the risk profile and investment thesis? The list goes on. After the decision to invest is made, then starts a whole new set of questions and analysis, like: How is the asset performing against projections? What are potential market risks? What do future projections look like? These questions last for the duration of the asset’s life cycle, which may be 20+ years.”

Without software like Mercatus’, companies have to answer these questions by compiling all the data manually. Information and valuation models are stored in multiple spreadsheets, presentations, and other files, scattered across departments and systems (internal and external). There is also data coming in from asset operators, portfolio companies, market indexes, and more. Asset and investment managers today spend an inordinate amount of time collecting and validating data inputs before they can run analytics and reports. If the underlying data is in any way incorrect, then all assumptions and models that follow will also be erroneous. Having all that data consolidated,accessible, and cleansed saves huge amounts of time, reduces errors, and increases speed and accuracy of investment decisions.

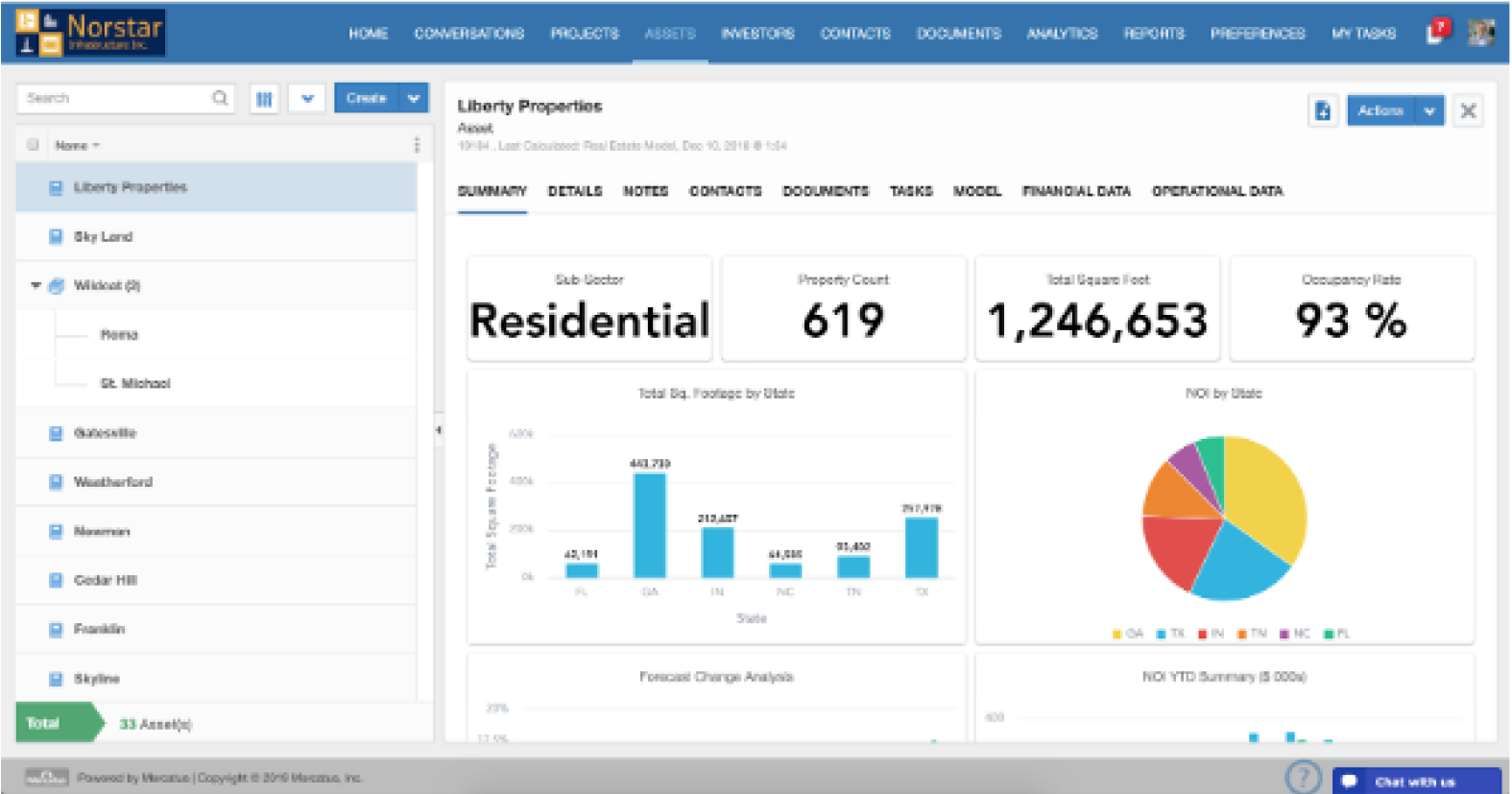

Mercatus gives investment managers a single source of truth that intelligently and dynamically centralizes all those scattered data sources so stakeholders can look at the whole portfolio and run analyses quickly, efficiently, and accurately. Mercatus also empowers its customers with more predictive, forward-looking scenario planning, so it’s not just a rear-view mirror to past performance. The goal is for the insights to be so seamlessly integrated into the business workflow that users aren’t even conscious that analytics are running in the background. They just know that they can get answers quickly—answers they can trust—and the data will not only tell them when something’s amiss, but the next best step or decision to make is obvious.

Unlike other systems that manage a portion of the investment process, Mercatus helps customers manage assets across the whole life cycle (from origination to divestiture), with built-in tools for data visualization and reporting, task management, compliance tracking, investor portal, and more.

Data + insights is key

Mercatus first launched its platform with a focus on data consolidation and management. The analytics followed. Mercatus’ customers began asking for insights and reporting capabilities that would let them see instantly how each asset is performing. Customers said their biggest challenge was around investor reporting across multiple assets and asset types. “The tipping point came when customers started requesting custom reports on a weekly basis for their executive team or board of investors,” says Adams. “One customer could have 50 projects or more going at the same time, each of which was subject to change at any time and required its own up-to-the-minute report. The inability to access real-time insights created a huge opportunity for us to add substantial value within our platform.”

The Mercatus journey started with a focus on energy asset owners, where they developed a deep understanding of the challenges and nuances of managing energy projects. The company recognized that there was an opportunity to heighten the value they deliver by expanding their capabilities to help investors of alternative assets—from energy to infrastructure, real estate, private equity, and more. With shrinking margins, compressed fees, and increasing competition across all alternative investments, the ability to differentiate and deliver superior returns by using data and analytics to drive optimal returns has proven to be a big win.

When the need for an analytics solution became apparent back in 2014, Mercatus considered the “build versus buy” question. “We knew that building a distributed analytics solution was not the business we wanted to be in,” Adams explains. “We didn’t have the expertise; we didn’t have the time to interview and hire a completely new team; and we certainly didn’t have the patience to build an analytics solution from scratch, knowing what it would take to get that right.”

Adams and his team knew that working with a partner would result in a more robust solution that they could bring to market faster than if they were to build their own. Choosing that partner turned out to be a fairly simple process. “We thought about what our customers were asking for, what our data uniquely enabled, and what we envisioned for the future of our platform, and we wrote it all down,” recalls Adams. “We looked at the short-term and long-term business outcomes we wanted to achieve and then we started looking at providers. GoodData checked all the boxes. They could get us to market quickly and then iterate and continuously grow with Mercatus as our needs expanded. We were looking for a long-term partner.”

Favorite Metrics:

- Internal Rate of Return (IRR)

- Distributions, Total Value, and Residual Value to paid-in Capital (DPI, TVPI, RVPI)

- Total Equity before Interest, Taxes, Depreciation, and Amortization (EBIDTA)

- Assets Under Management (AUM)

- % of transactions assessed under Environmental, Social, and Governance policy (% transactions ESG assessed)

Flipping the switch

Mercatus began working with GoodData in 2014. “We had a tight deadline and needed to get to market very quickly with our first MVP—6 weeks,” notes Adams. “GoodData was able to get us up and running within our time frame. Since then, we’ve been able to iterate and continue to add more to continuously exceed customer expectations.”

Part of the implementation process involved a full product workshop, conducted by GoodData, focused on the end user pain points, like a need for real-time performance reports, more accurate risk profiles, and process automation. “After that workshop, we had total confidence that GoodData was the partner for us,” Tom Vogt, VP, Customer Success, recalls.

“It was immediately clear that their expertise and track record of hundreds of successful deployments would be crucial to putting us on the path to success, and they worked closely with us throughout the implementation process to make sure that the platform was meeting all our needs.”

Best Features:

- Consolidation of asset data, workflow, and financial models

- Data integrity, “trust”

- Predictive analytics

- Data-driven investor reports

Delivering powerful results

Mercatus’ analytics platform allows customers to see exactly how every asset is performing, with speed, accuracy, and efficiency not available before. This information helps customers make decisions around investments, address issues that may be arising in real time, and become aware of the potential risk more proactively.

“Our industry is still somewhat immature in terms of using data, even though a ton of data is collected on a daily basis,” explains Adams. “By implementing an analytics solution, we were able to fill a void that our competitors hadn’t and take on a leadership role in advancing the industry as a whole.”

Because it offers a unique capability, Mercatus’ analytics features have become an integral part of the platform. “Without the analytics, the data is less actionable, less meaningful,” Adams notes. “It’s been the deciding factor in many of our sales, and it’s a key differentiator for us in the market.”

Mercatus customers have benefitted from more accurate forecasting, error-free reports, and data-driven predictive insights. Internally, Mercatus has been able to easily maintain the platform with a four-person team.

Recently, Mercatus began leveraging GoodData Spectrum to build stunning data visualizations and empower its users to build their own visualizations. “We realized we need to empower the business user to accelerate their decision making and give them the ability to create visualizations on their own,” said Adams. “Since we began using GoodData Spectrum, our customers no longer have to depend on our analytics teams or customer success teams to build their data visualizations or extract insights.”

Results:

- 2 year advantage in time to market over their competitors

- Saved 2-3 hours per customer per week in reporting time

- Shortened sales cycle by 80%

- Increased sales due to analytics being key selling point

- Achieved significant gains in upsell revenue

For those users who need additional help creating their own visualizations, Mercatus introduced an intuitive wizardbased recommendation engine. “This recommendation technology empowers the user to take control, to find the answers to their most pressing questions without being dependent on an IT organization or anyone else,” explained Adams.

GoodData is the insights interface within the Mercatus product today, and Mercatus is moving forward with plans to roll out a benchmarking feature. “We’re actually doing our own analysis on large sets of anonymized data in our platform, and it’s very powerful for helping to highlight realworld trends, predict market opportunities, and more,” Adams reports.

“This is one more tool in the arsenal for our customers as we can help them evaluate new markets, benchmark their own performance against peers, and more. In the investment world, 1+1 (e.g., data + analytics) = so much more than 3. It’s the competitive edge today’s investors need to survive and thrive.”

Why the world’s top companies choose GoodData

At GoodData, we believe that traditional data tools are no longer enough. Our Data as a Service (DaaS) infrastructure is the future of analytics: real-time, open, secure, and scalable.

GoodData’s leading cloud native analytics platform gives our customers the flexibility to build and scale any of their data use cases; from self-service and embeddable analytics, to machine learning and IoT — while maintaining the performance, cost-efficiency, and easy change management of such a central and integrated solution.

GoodData has teams and data centers in the USA, Europe and Asia, with customers including leading software companies (SaaS), global financial and payment institutions and multi-brand e-commerce platforms.

Does GoodData look like the better fit?

Get a demo now and see for yourself. It’s commitment-free.